Before discussing the topic of forced appreciation, I feel that I need to give you some context. Real property appreciates or depreciates in value due to different market forces on the different types of property. In other words, each type of property has its own set of rules. Where single-family homes rely on comps (external forces) to determine value, commercial real estate is valued by the underlying business (internal forces) or income stream of the property. Withing the broad category of commercial real estate is multifamily property, which is defined as a property having 5 or more rental units (doors).

Forced appreciation is the increase in the value of an investment property due to an investor’s actions, in this case, making it more profitable. Contrast this with natural appreciation, sometimes called market appreciation, where uncontrollable (by the investor) market forces are at play.

Single-Family Home Appreciation

Single-family home values are more susceptible to external forces such as supply, interest rates, inflation, and location. They get their value based on comparable sales (comps), which are the single most powerful driving force for the value of a single-family home. People who want to make money in the single-family space are at the mercy of the residential real estate market.

Investors in this type of property have no influence over the value of a property, other than presenting it in the best light possible through shrewd marketing – and hoping and praying for the best. Single-family house flippers make their money by finding a property at a very low and undervalued (discounted) price, making the repairs on it to bring it up to current market standards, and then selling it for whatever the market will bear. I used to flip houses in the 90s and early 2000s, and discovered that I made money when I bought the property, though realized the profit when I sold. What I mean by this is that I only made money when I bought a property at an artificially low value because of its disrepair. There was no way for me to sell the property at the end for more than its after-repaired value.

How it Works for Multifamily Properties

Commercial real estate, such as an apartment complex, is less influenced by uncontrollable market forces. Instead, it is up to the syndicator, through proactive management, to have an impact on the forced appreciation of a property. The single most important calculation of value is derived from the net operating income (NOI) as related to the prevailing cap rate of the area and/or class of the property. Two of the main ways a syndicator increases a property’s value is by increasing rental income and decreasing expenses. Here are some of the ways this can be accomplished:

Increasing Income

- Raising Rents

- Minimizing Vacancies

- Adding Amenities that Raise Rents

- Extra Bathrooms

- Washer & Dryer

- Club House

- Common Area Improvements

- Internet and Cable Contracts

- Curb Appeal

- Short-Term Rentals

- Concessions or Enticements

- Regular Review of Comparable Rents in the Market

Decreasing Expenses

- Billing Back Utilities to Tenants

- Managing Energy Use

- Minimizing Water Use Through Efficient Fixtures

- Re-Negotiating Service Contracts

- Negotiating Better Construction Supply Prices

- Proactive Maintenance

- Better Tenant Screening

Net Operating Income (NOI) & Capitalization (Cap) Rate

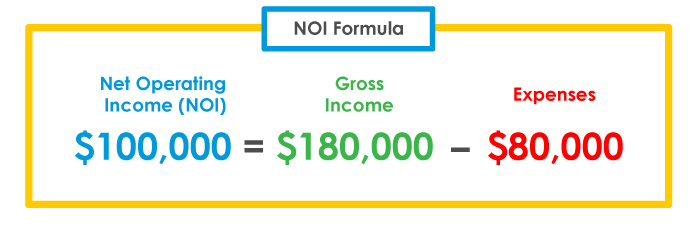

NOI is calculated from rental and other income a multifamily property produces, minus all the expenses and salaries needed to manage a property. This does not include expenses for servicing debt, like mortgage payments. Nor does it include any cash distributions to any general or limited partners (investors).

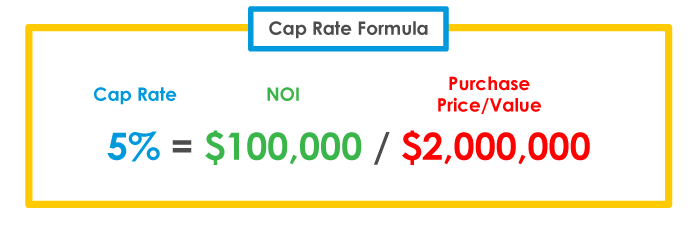

The cap rate Is an important metric used to determine a property’s value as compared to similar properties. Generally, the prevailing cap rate of an area works similarly to the comps used in single-family housing. Using this prevailing cap rate and calculating it with the NOI gives you a property’s value as compared to comparable properties. In a way, the cap rate can be thought of as a comp. Another way to look at it is the yield of an investment over a 1-year time horizon with an all cash purchase. It tells you how much you would make on an investment if you paid only cash for it (no financing), and is the NOI divided by the purchase price.

Ways to Force Appreciation

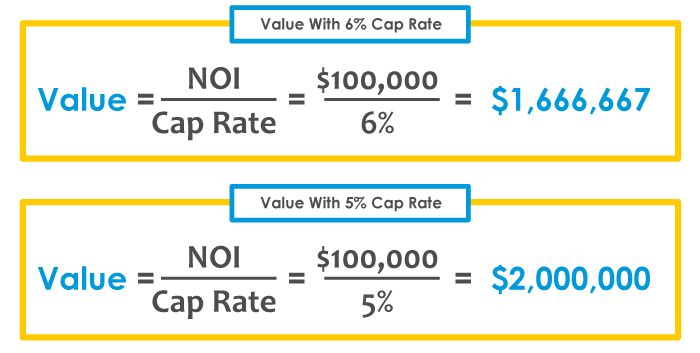

Along with reducing expenses and increasing rents and income, another key concept should be noted. When a syndicator makes improvements to a property, it is sometimes possible to reduce the cap rate (a good thing) by elevating the class of a property. What I mean by this is easier to illustrate with an example. Say you have a class C property in a class B neighborhood. This would be a property that is showing its wear and tear or deferred maintenance, and when repaired and improved could (again) be turned into a class B property. A class C cap rate in an area might be 6% while a class B property might be 5%. Watch what happens with the math when we go from a 6 cap to a 5 cap:

Change in Value

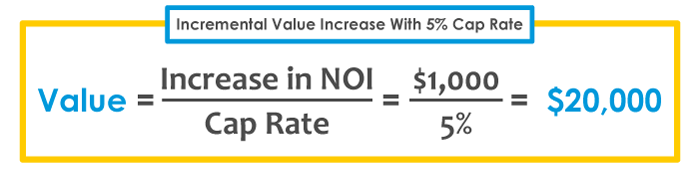

If you change something for the better, in this case, a higher amount of net operating income, here’s what happens to the value:

Incremental Change

Example: A class B property with a 5% cap rate and net operating income of $100,000 per year has an accepted value of $2,000,000. Bringing in $50,000 per year (which is not very difficult by the way) boosts the value to $3,000,000. Note that for every $1,000 in yearly savings or profit increase yields $20,000 in additional value. This is so powerful. Doubling the NOI doubles the property value.

Business Plans

We now know that value is a function of cap rate and net operating income (NOI). NOI has a very direct influence on value for a multifamily property. Since syndicators can control the NOI, this will be listed on a business plan as you review an investment opportunity. Most syndicators’ business plans will outline HOW they will be forcing the increase in value over time. Whether they are taking advantage of lazy sellers who haven’t kept up with rents, or finding ways to be more cost efficient, forced appreciation presents one of the fastest ways to increase value in a relatively shorter length of time.

Helpful Reading

The Hands-Off Investor, an Insider’s Guide to Investing in Passive Real Estate Syndications by Brian Burke