I think you can interpret what I’m saying here. When you start investing in apartment complexes, you can expose yourself to needless risks in the form of tenant lawsuits. It is wise to do it the right way. Luckily, most syndications can offer several layers of protection.

Doing it Yourself by Buying in Your Name

This is perhaps one of the biggest mistakes people can make when they are growing their portfolio of real estate. Like when you bought your main residence, you probably gained title in your own name. It’s an honest mistake which can be mitigated by transferring title to a trust. But that’s outside the scope of this article.

When you amass a real estate portfolio all in your personal name, you are actually exposing all those properties to lawsuits that, if ruled against you and if you are found to be liable for injuries or damages, can separate you from ALL your property. When it took so much effort throughout your lifetime to accumulate these properties, why would you want to run the risk of having it all taken away from you?

So, what are those layers of protection I mentioned earlier? They are carrying adequate insurance, compartmentalizing your assets by using various company structures, and using anonymity to your advantage.

Insurance

It probably goes without saying that insurance is your first line of defense, and no matter how you structure your ownership, you should definitely carry a more-than-adequate insurance policy. In the event of a mishap, hopefully, a payout may be adequate to stop a lawsuit before it is even considered. But even so, this might not be enough. Additionally, gross negligence is perhaps the one area that most insurance policies do not cover. Negligence maybe. But definitely not gross negligence and willful misconduct.

Each property should have its own insurance policy, but many property owners go one step further by employing an umbrella policy. This is an extra insurance policy that provides protection above and beyond existing coverage limits of other policies, and can cover an entire portfolio of properties. Like normal insurance, an umbrella policy can provide coverage for certain lawsuits, property damage, injuries, and personal liability.

Compartmentalization

I order to protect yourself against claims, you need to proverbially build walls around your assets. One of the ways you can do this is to establish a limited liability company (LLC) for each asset. You can also have LLCs owned by other LLCs, giving you several barriers between assets and preventing judgments or lawsuits against one LLC from being able to take from another LLC. In the eyes of the courts, only the assets owned by a given LLC could be subject to any judgments, protecting your personal assets and money that are not part of that LLC.

Anonymity

Some states allow an LLC to be set up without recording the owners’ personal names. This allows you to own assets anonymously, providing an additional barrier against claims or judgments. Since this can legally be used to obscure your net worth, it helps to further insulate you from having your personal finances garnished in the case of a bankruptcy or default on a loan.

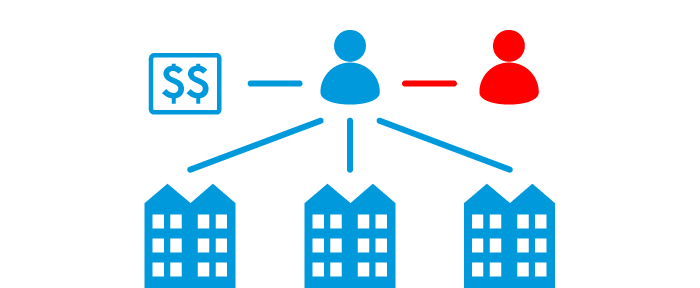

Bad – Ownership Diagrams

If you own a lot of property in your own name, you leave yourself exposed to liability for claims against you that you might not even have control over. For example, the red guy below is suing you, the blue guy, because he slipped on ice and fell at one of your apartment complexes, breaking his arm. You were smart in that you had insurance that covered the medical bills and then some. But Mr. Red doesn’t think that is enough. He tries to come after you, saying that the ice wasn’t cleared fast enough, even though you made your best efforts to do so, and he is asking for punitive damages in the amount of the full value of all your properties and including any cash you might have in your bank account. He knows that he has a good chance of getting most of what he is asking because other courts have ruled in the plaintiff’s favor for cases very similar to this. This is where you could have been smarter.

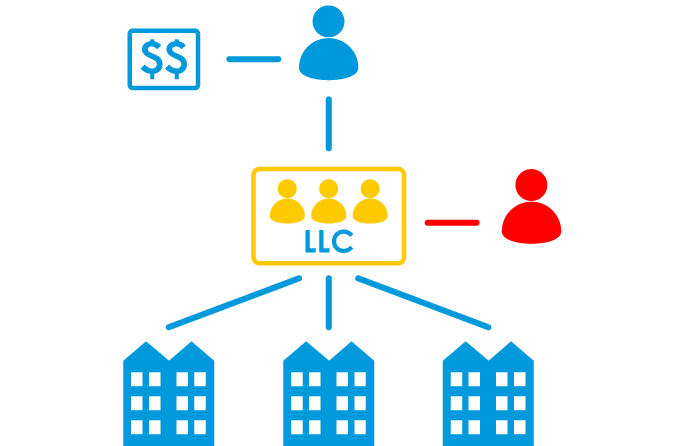

The diagram below shows one step toward preventing this from happening again. While organizing your assets in this way can keep your money and other personal property out of the hands of would-be litigants, it still has one problem. If Mr. Red sues the owner of the property, an LLC, he sees that the LLC owns other properties and includes them in his lawsuit.

Better – Ownership Diagram

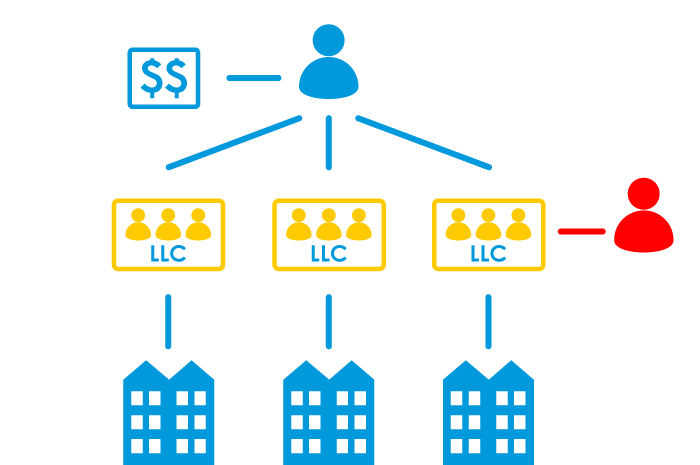

In the diagram below, you go one step further and put each property in its own LLC. This is usually very good planning. Each property is somewhat shielded from liability from the other properties. The plaintiff in a case can only go after the assets in that one single LLC, UNLESS they can crack open the corporate veil, exposing any owners. In the case below if this happens, the plaintiff will have access to you, your money, and any other properties you might own. But this is very hard to do, so this set-up keeps you much safer from Mr. Red than the options above.

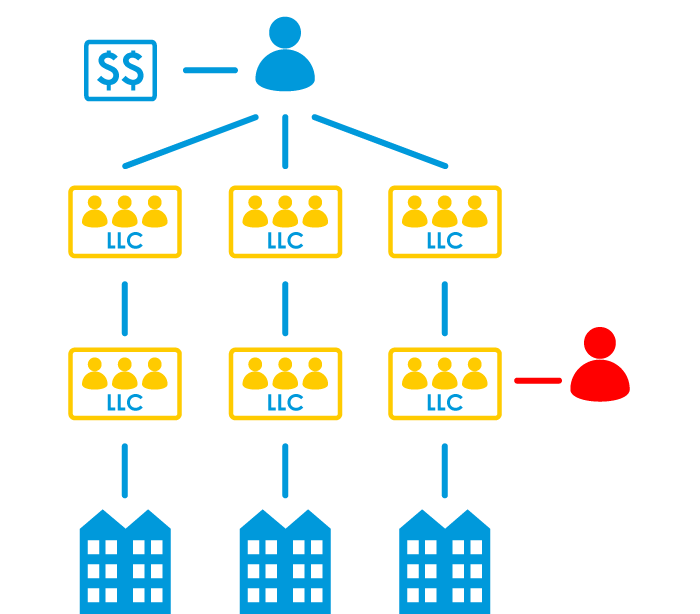

Best – Ownership Diagrams

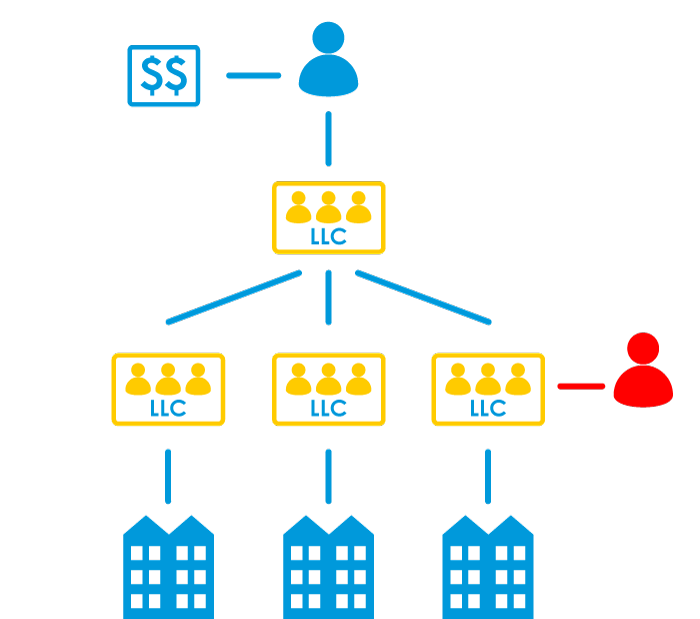

Some syndications will own several properties, such as via a blind fund. In the diagram below, you are an investor of one such organization. As in the diagram above, each property is better shielded from liability from the other properties. The plaintiff in a case can only go after the assets in that one single LLC. And if they penetrate the corporate veil, they will only find another entity, therefore further removing your personal assets and money from exposure.

When you invest in several syndications, in this case 3 of them, this is how it will normally look. You would have an ownership stake in the LLC that is responsible for managing a property owned by another LLC. This keeps you very well protected against any claims by Mr. Red.

Layering

Using all these tools is like building a layer cake, especially when investing in a syndication. The first layer is the insurance. Make sure that the sponsor is carrying the right kind of policy, depending on the need. And if the property is in a flood plain, it is imperative that they carry flood insurance. The second layer is the use of entities like an LLC. This will protect your personal net worth if ever there is a court challenge over the property you are investing in. All liabilities will be limited by the value of the property in the LLC. The third layer is anonymity. Even if the syndicator is named in the recording documents, chances are that your name is not. Make sure you’re protected by covering your assets.