First of all, let’s address the alphabet soup in understanding returns. CoC stands for Cash-on-Cash Return, IRR means Internal Rate of Return, and AAR is Average Annual Return. They are all various measures of how profitable an investment might be, though have their own characteristics. The different metrics are used to help compare apples to apples.

Understanding Returns – CoC

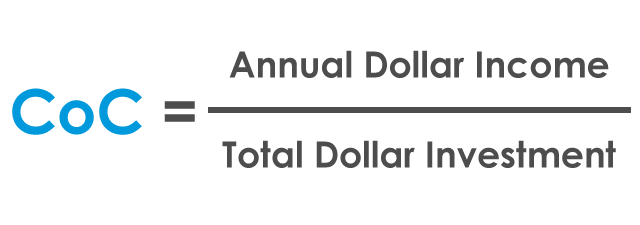

The CoC return (and sometimes indicated as CCR), for an investment measures the amount of cash flow a project will generate as a percentage of the total invested cash. This can also be referred to as the equity dividend rate, and you can almost view this like the interest rate on a savings account. This capital gain is expressed as a percentage and can be used to compare the projected returns that a real estate syndication investment might offer, and is an average annual rate for the length of that project. By the way, though this term is most commonly used in the context of real estate, it can apply to other investments as well. The equivalent in stocks would be noted as the return on investment, or ROI, except that in this case the CoC does not include any of the profits of a sale.*

Formula:

CoC = annual net operating income (NOI) divided by the total cash invested.

NOI is the annual rental income minus operating expenses, not including debt service.

Because the CoC return is a basic metric, it won’t tell you everything about a project. It doesn’t factor in appreciation of the apartment community, nor do tax benefits enter into the calculation. Therefore, it’s only a signal of an investment’s possible profitability, and further in-depth analysis should be conducted using some of the other metrics before making an investment decision. Note that a project’s cash flow can fluctuate dramatically from month to month as well as year to year depending on what the business plan may call for, and this metric is an annual average.

Caution

Some syndicators calculate the CoC with and without the proceeds from the project’s appreciation. I personally feel that the profit should be left out of the CoC calculation since you can see its effect in the average annual return. But… the AAR is yet another formula that can be calculated with and without profit. Make sure you know what flavor of the numbers that are being presented. It is my opinion that the AAR should include the profit in its calculation.

Understanding Returns – IRR

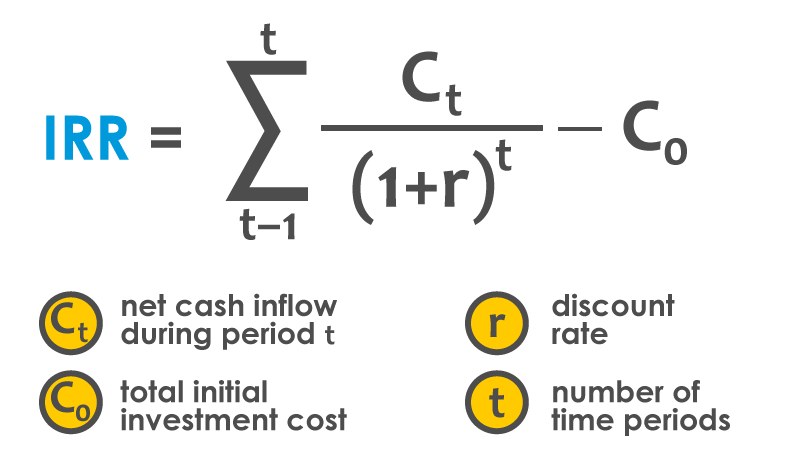

This can be a difficult concept for some to understand. Basically, it is the percentage rate earned on each dollar invested for each period that it is invested. The internal rate of return (IRR) is a method of calculating a real estate investment’s rate of return, or annualized effective compounded return rate. The term internal refers to the fact that the calculation excludes external factors, such as the risk-free rate, inflation, the cost of capital, or financial risk. The IRR is an estimate of a future annual rate of return, and can also measure the actual achieved investment return of an investment. You may also hear the term discounted cash flow rate of return (DCFROR), which is essentially the same.

IRR accounts for the time value of money. A given return on investment received at any given time is worth more than the same return received at a later time, so the latter would yield a lower IRR than the former, if all other factors are equal. In other words, if the amount returned on an investment is the same, the IRR would get lower as the time it takes to get that return is stretched out.

What this measurement is really good for is to provide an oranges-to-oranges comparison of investment opportunities that have holding periods over a different number of years. It should be noted that the IRR does not necessarily equal the annual compound rate of return, and should not be confused with CoC and AAR.

Formula:

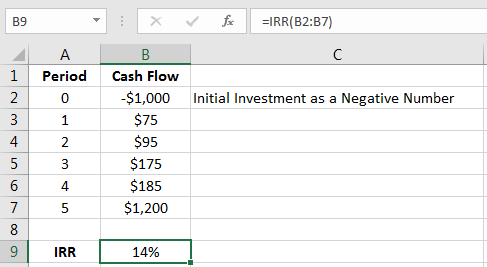

If using Microsoft Excel, here is what the formula would look like:

Note that this includes return of capital as well as the periodic returns.

Understanding Returns – AAR

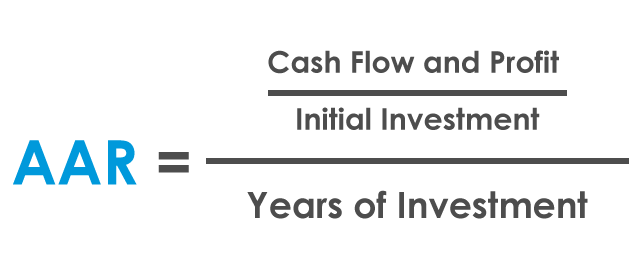

This is the average annual return an investment produces. Not to be confused with return on investment, in this context, AAR includes the return of investment plus any profit in the form of cash the project generates as well as the appreciation, and is divided by the number of years the project is held. It is expressed as a percentage, and doesn’t take into account any effects of compounding. Phew!… That was a mouthful.

In its simplest terms, AAR measures the money made or lost by a real estate investment over a given period of time. You will want to consider the AAR when looking at syndication opportunities and compare it with others. This allows for the comparison of projects that have different time horizons. Say for an example that projected returns on a $100K investment will be $100K over 10 years, giving you $200K at the end. This works out to be a 10% average annual return. Now if you are looking at a similar opportunity that returns the same amount over a 5-year period, you would calculate the AAR to be 20%. I think we would agree that the second opportunity is the better option, all other things considered equal.

Formula:

An AAR that you should be looking for is anywhere between 13% and 20%, taking into account risks such as asset class. A class A stabilized project will likely return on the low end of this spectrum, where a class C project with high vacancy rates should give you a return on the high side.

What Returns Are Considered Good?

Investors disagree on the overall return numbers. Some say that anything above 7% is great, and that they aim for a rate in the range 7-13%. Other investors wouldn’t even trouble themselves with a syndication if it doesn’t promise them a cash-on-cash return of 19% or more. (Perhaps they are confusing CoC with AAR.) The cash-on-cash return also fluctuates from month to month, from different property classes, from one city to another, and from one business plan to another.

Here’s my two cents:

I like to see CoC from 6.5% to 10%, IRR in the range of 13% to 18%, and AAR anywhere from 10% to 17%. If you see promises of returns much bigger than these ranges, you might need to dig into the numbers and verify assumptions. You need to make sure that you are not being promised the moon since real life just doesn’t happen that way.