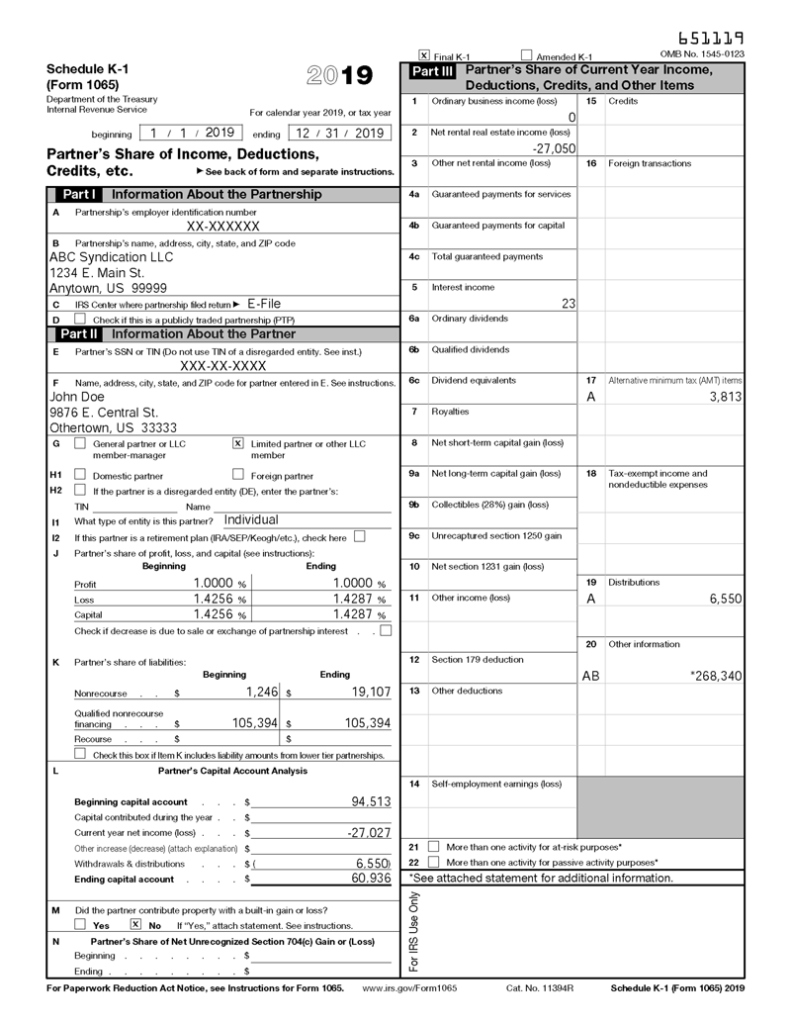

First of all, what is a K-1 Tax Form?

As part of an IRS income tax filing, the Schedule K-1 tax form is the annual reporting that you will receive from the sponsor in a multifamily syndication. It is similar in purpose to the Form 1099. The syndication LLC files an information return to report their income, gains, losses, deductions, credits, and the K-1 tax form lists the beneficiary’s share of these incomes, deductions, credits.

The LLC does not pay tax on its income but “passes through” any profits or losses to its investors, who in turn must include K-1 item info on their tax or information returns. You may be liable for tax on your share of the syndication income, whether or not distributed. Do not attach the K-1 tax form to your personal tax return unless you are specifically required to do so, as the syndicator will have already reported its contents to the IRS. Keep it for your records.

Basis of Investment

The basis of property you buy or investments you make is usually its original cost. The cost is the amount you pay in cash, debt obligations, other property, or services. Your original basis in property is adjusted (increased or decreased) by certain events. If a sponsor makes improvements to the property, your basis is increased. If you take deductions for depreciation or casualty losses, your basis is reduced.

You may also have to capitalize (add to basis) certain other costs related to buying or investing in property. When you invest in real property, certain fees and other expenses become part of your cost basis in the property, which include settlement costs, legal and due diligence fees. The K-1 tax form helps keep track of your basis and how it changes throughout the course of the investment.

Box J

The percentages reported here are based on the limited partner’s ownership (your) percentage. This also shows any changes that might have happened throughout the year. The amounts reported in item J are based on the operating agreement. The ending percentage share shown on the Capital line is the portion of the capital you would receive if the syndication was liquidated at the end of its tax year by the distribution of undivided interests in the syndication’s assets and liabilities. If your capital account is negative or zero, the partnership will have entered zero on this line.

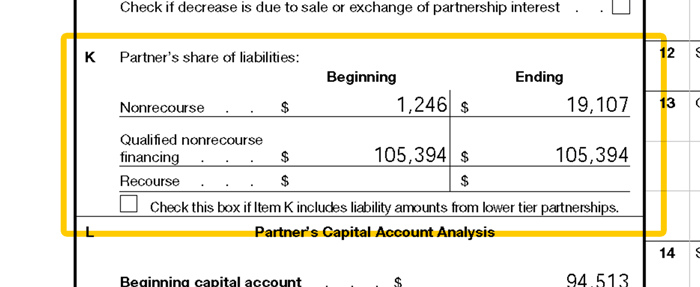

Box K

Typically, higher dollar amount debt financing is in the form of a non-recourse loan, meaning that upon default, the bank cannot go after the assets of those involved with the general partnership to satisfy any unpaid balances that liquidation of the property doesn’t cover. Most loans over $2,000,000 are non-recourse loans.

Item K should show your share of the syndication’s non-recourse liabilities at the beginning and the end of the partnership’s tax year. If you terminated your interest in the syndication during the tax year, item K should show the share that existed immediately before the total disposition. A partner’s “recourse liability” is any partnership liability for which a partner is personally liable.

Box L

Box L reports the basis of your investment rather than the actual value of the investment. This item also shows changes in your capital account for the year the K-1 tax form is reporting. The beginning capital account balance is the starting point of your basis or is carried over from the previous years’ ending capital account balance. The next 4 lines report the amounts and effects of income and distributions over the reporting year. The last line is the new basis which will be carried over to the following year.

The reason this is important is that if there is a sale of the property, the negative number listed would represent the capital gain you would be responsible for. A positive number in this case would be treated as a capital loss. When some syndicators sell a property, the capital account can be zeroed out and the amount in box 10 is the capital gain along with any recapture in box 9.

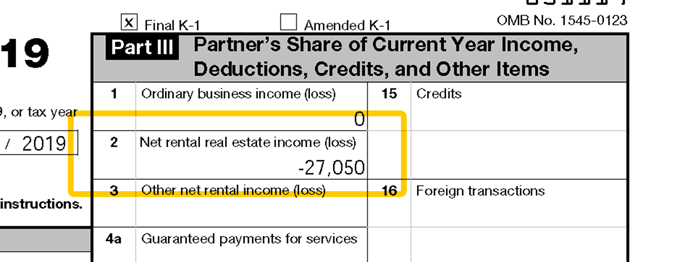

Box 2

This box will show your share of the net rental real estate income or loss from the syndication. Generally, the income and loss reported in box 2 is a passive activity amount for all limited partners. Passive in this context means that you are not acting as a real estate professional within the framework of this investment and that you did not participate in any of the day-to-day management or overall asset management for this property.

This number is used to calculate the income tax you, the limited partner, must pay and is treated as ordinary income. For example, if $12,300 was listed in box 2, and you were in the 40% tax bracket (ignoring any other income or tax circumstances) you would owe $4,920 in federal taxes. In the example below, there is a loss of $27,050, allowing you to offset any passive income you might have in that amount and protect it from any taxes.

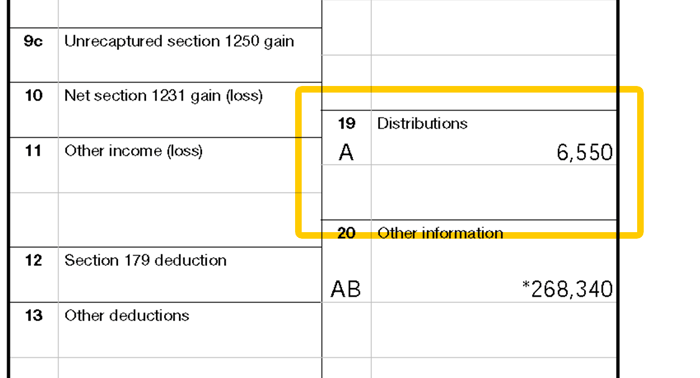

Box 19

Distributions are amounts paid to you and include the following:

- A withdrawal by a partner in anticipation of the current year’s earnings.

- A distribution of the current year’s or prior years’ earnings not needed for working capital.

- A complete or partial liquidation of a partner’s interest.

- A distribution to all partners in a complete liquidation of the partnership.

It is common for your K-1 tax form to show a loss due to non-cash deductions like depreciation.

Box 19 shows the total amount of distributions paid. In the example below, the limited partner has received a distribution of $6,550. If you compare this to our box 2 example, you will note that the full $6,550 is shielded against tax because the loss is greater than that. In fact, there will be a carryover loss of $20,500 that can be used in subsequent tax years. If the amount of the distribution in box 19 had been greater than the loss in box 2, you would need to count that overage as income and you would be subject to the tax on that amount. Phew! That’s a lot to think about.

Box 20

This is where you might find some miscellaneous items that do not belong to any specific box. The key to the codes is on page 2 of the form.

Delays

K-1s are usually delivered to investors at the beginning of April each year, but occasionally, due to the complexities involved around the syndication finalizing the LLC’s tax returns, it is not unheard of to receive them much later in the year, like in the fall. It is often advisable to file for an extension so that you do not get hit with a failure-to-file penalty. Estimated taxes still have to be paid at this point, so you might need to contact your investor relations contact for the syndication and ask for draft K-1s. This will help you determine your estimated tax liability (if there is one).

Final Notes

Most of the time you will not pay taxes on any money that the LLC distributes unless and until the amount that was distributed exceeds your investment in the syndication. If you were to receive funds from distributions but the K-1 tax form you receive shows a passive loss, you would not pay any taxes due to the loss reported. Distributions in this case would instead lower your basis in the investment while at the same time be considered a return of capital.

Be on the lookout for K-1 tax forms being sent to you for the tax year following the winding down tax year of the syndication investment. There are sometimes lagging fees (like property taxes or expenses) that the sponsor still has to pay, and you may be eligible to take the deduction as a capital loss. Contact your tax planner/professional for details and your resulting action plan.

Helpful Links

If you want to study the K-1 tax form, it can be downloaded here:

https://www.irs.gov/pub/irs-pdf/f1065sk1.pdf

https://www.irs.gov/pub/irs-pdf/i1065sk1.pdf

When it is time to do your taxes:

H&R Block Tax Software Deluxe + State 2023

TurboTax Home & Business 2023 Tax Software, Federal & State Tax Return