One of the newest sets of tax rules available to us is the inducements around opportunity zones, calling for us to re-invest our unrealized capital gains into projects that help local communities. The US Government has established certain areas of the US that it wants to improve, and has implemented tax incentives to investors to help out by financially stimulating those areas. By participating in opportunity zone investment opportunities, we can defer and sometimes eliminate taxes on capital gains.

What is an opportunity zone?

Also referred to as a qualified opportunity zone (QOZ), the Internal Revenue Service (IRS) defines it as an economically distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment. Areas qualify as QOZs if they have been chosen for that designation by a state, the District of Columbia, or a U.S. territory and that nomination has been certified by the Secretary of the U.S. Treasury via his delegation of authority to the IRS.

Opportunity zones are designed to spur economic development and job creation in distressed neighborhoods by providing tax incentives for investors who invest new capital in businesses operating in one or more QOZs. Some of this capital can be the proceeds from a non-opportunity zone investment as long as it is reinvested into a qualified opportunity zone or fund, but only during the 180-day period beginning on the date of the sale of non-qualified investment. There are certain rules around this, so check with the IRS or your professional tax or financial planner.

Opportunity zones were created under the Tax Cuts and Jobs Act of 2017, and the program lasts through 2026. The first set of opportunity zone selections, covering parts of 18 states, were designated on April 9, 2018. Thousands of low-income communities in all 50 states, the District of Columbia and five U.S. territories are designated as qualified opportunity zones. You can invest in these zones through qualified opportunity funds.

What’s in it for investors?

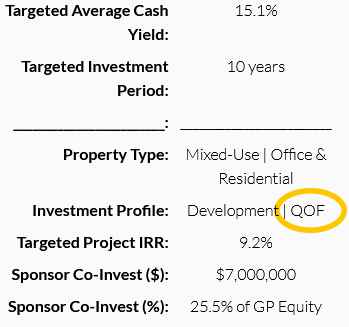

First, an investor can defer tax on any prior eligible gain to the extent that a corresponding amount is timely invested in a qualified opportunity fund (QOF). A QOF is an investment fund that files either a partnership or corporate federal income tax return and is organized for the purpose of investing in QOZ property. It is very common for multifamily real estate to be included in a qualified opportunity zone.

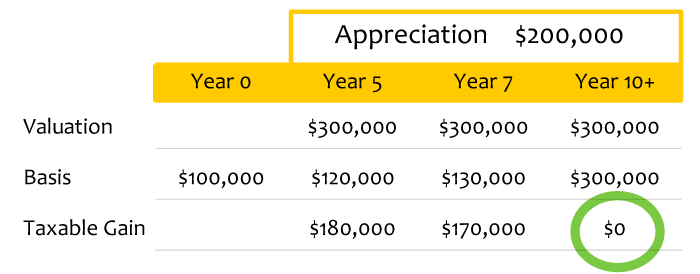

The deferral lasts until the earlier of the date on which the investment in the QOF is sold or exchanged, or December 31, 2026. If the QOF investment is held for at least 5 years, there is a 10% exclusion of the deferred gain. If held for at least 7 years, the 10% exclusion becomes 15%. Additionally, the amount of eligible gain to include is decreased to the extent that the amount of eligible gain you deferred exceeds the fair market value of the investment in the QOF.

Second, if the investor holds the investment in the QOF for at least 10 years, the investor is eligible for an adjustment in the basis of the QOF investment to its fair market value on the date that the QOF investment is sold or exchanged. As a result of this basis adjustment, the appreciation in the QOF investment is never taxed. A similar rule applies to exclude the QOF investor’s share of gain and loss from sales of QOF assets.

Summary of the 3 Tax Benefits

Here’s a hypothetical example of what happens to a $100,000 investment. Let’s say that at the end of the 5-, 7- or 10-year hold that the investment was now worth $300,000. If this investment were not in an opportunity zone, you would have to pay tax on $200,000. The opportunity zone investment gets a bit of a break in years 5 through 7, and gets a substantial break in year 10.

What types of gains are eligible for deferral if I invest in a QOF?

Gains that may be deferred are called eligible gains. They include both capital gains and qualified 1231 gains, but only profits that would be recognized for federal income tax purposes before January 1, 2027, and that are not from a transaction with a related person. For you to obtain this deferral, the amount of the eligible gain must be timely invested in a QOF in exchange for an equity interest in the QOF (qualifying investment). Once you have done this, you can claim the deferral on your federal income tax return for the taxable year in which the gain would be recognized if you do not defer it.

You can make a partial or full election to defer the gain when filing your federal income tax return. In other words, you can make the election on the return on which the tax on that gain would be due if you didn’t defer it.

What types of multifamily projects should I expect in an opportunity zone?

Since part of what defines a qualifying opportunity zone property is the amount of improvement projected, you will likely see a lot of ground-up development investment opportunities. Substantial improvement is the key. Property is substantially improved if, during any 30-month period beginning after the property is acquired, additions to the basis of the property exceed an amount equal to the adjusted basis at the start of the 30-month period.

But another defining factor of an opportunity zone business is the 50% of gross income test. Each taxable year, a QOZ business must earn at least 50% of its gross income from business activities within a QOZ. The operation of an apartment complex usually passes this test by its very nature.

How to Find Opportunity Zone Maps

One of the best ways to do this is to Google it. Using the search terms “opportunity zone map” and your city will usually bring up lots of resources that can help. See the example below.

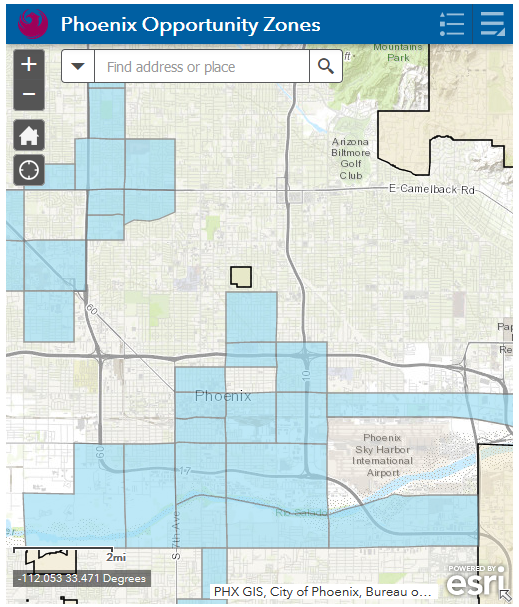

In this example, if you clicked the first link, you might find something like this:

Final Thoughts

When you are being presented with an investment opportunity through a multifamily syndication sponsor, he/she will likely be fully aware if the project qualifies as an opportunity fund in an opportunity zone, and that will be one of the main features of the investment. If you are unsure, you can always ask.