When looking at different multifamily opportunities, you need to be aware of the split, or what’s called the promote. In its simplest form, this is the distribution of profits that go to the syndicator/operator, versus the investor (limited partner). An offering will generally specify the percentage of profits and where they go. It is common for 10% to 30% of profits to go to the operator, with the remaining going to the investors, subject to various conditions. Though each deal may be different, the operator usually tries to find the right balance between their abilities and the needs of their investors.

Roles of a syndication’s general and limited partners:

General Partners: These are the organizers who provide the work.

Limited Partners: These are the investors who provide the initial capital.

Like snowflakes, every syndication or real estate deal is different. Let’s dig into the 2 most common split structures used in real estate investments today – the Straight Split and the Waterfall. Keep in mind that the operator, sometimes referred to as the promoter, gains their percentage of proceeds of a project through their sweat, work and management of a property, even though most of the money needed to get a project off the ground is provided by the limited partners.

Some multifamily syndications offer greater potential returns to investors, but with a higher rate of risk, while others are more conservative. The amount of risk will have a direct effect on the structure of the split or waterfall offered. Among many other factors, these variations in the structure of the deal are often due to the personal preferences of the general partners and their track record, the needs of their investors, the areas they’re investing in, the individual multifamily property, and where we are in the market cycle.

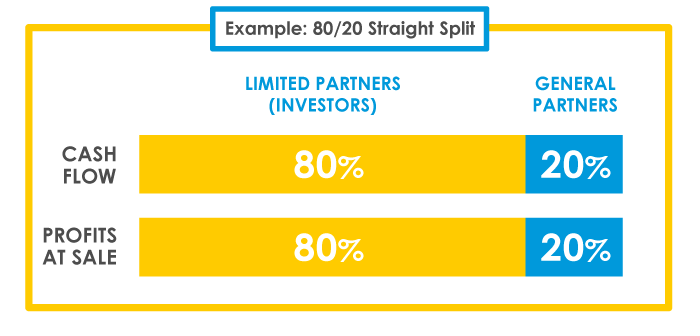

Straight Split

The easiest split to understand is the straight split. This deal structure uses a single specified split for all returns, including cash flows, as well as any gains from the sale of the asset at the end of the project. For example, if a syndication offers a 90/10 split, that means that 90% of all returns (profits and cash flows) go to the limited partners, the group of investors who have invested passively in the syndication, and 10% goes to the deal sponsors/organizers (general partners), compensating them for doing the actual work involved in an investment.

The above example might take into account that this is a higher-risk project, and therefor the higher percentage of return. A more conservative syndication project might offer a 70/30 split, where the limited partners get 70% of all profits and cash flows across the board, while the general partners receive 30% as their compensation.

Waterfall Structure

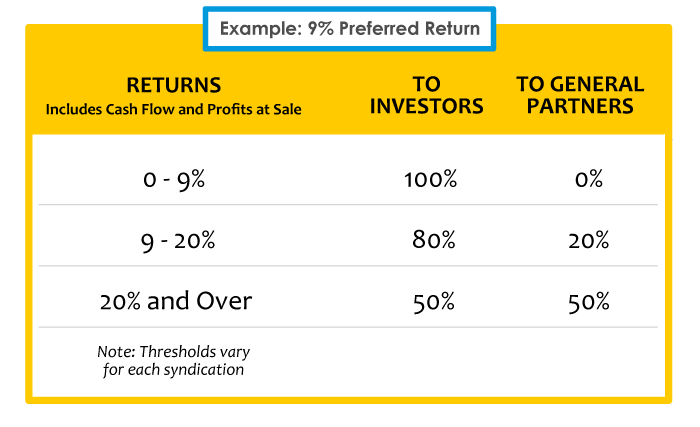

This split is a little more complex and is usually designed to incentivize general partners to perform for their investors. This is often viewed as an alignment of interests. The general partners can earn more when they over-perform, and in turn, the investors can make more. Let’s start with the Preferred Return, also known as the ‘Pref’. (Remember that a preferred rate is not guaranteed… A syndication project might not do as well as expected.)

Preferred Return – This is a structure that would give investors 100% of any returns or proceeds up to a certain percentage. For example, let’s say you invest $50,000 into a multifamily syndication with a 9% preferred return. During the first year, the returns are 9%. That means that investors get the full 9% pref. In other words, you would get $4,500, or 9% of your original $50,000 investment. The general partners do not receive any of these proceeds. But let’s say that the returns are 13%. In this case, the investor gets the first 9%, and then the remaining 4% gets split between the investors and the operators at the agreed split. If at the 9% threshold and above, the split is 80/20, the investor would receive their $4,500 plus $1,600 (80% of the representative share of $2,000).

There can be further steps or thresholds that allow for more enhanced profit sharing for the operators if the perform well. In the above example, we saw that the first 9% of any and all proceeds go to the limited partners at 100%, and then the amounts above were split 80/20. We are going to add another threshold. Anything above 20% will now be split 50/50. So, if a project does really well and makes 25% in a given period, the limited partner will get 100% of the first 9% of profits, 80% of the amount between 9% and 20%, and then receive 50% of the remaining 5%.

These waterfall structures can seem quite complex, but are more easily understood when seen in chart or picture form:

The waterfall structure is usually a win-win for the general and limited partners. It represents an excellent alignment of interests for all sides. Syndicators don’t generally take on a project unless they were fairly confident it can create proceeds above and beyond the preferred rate of return. And, the syndicators are incentivized to work as hard as they possibly can on behalf of the project and your investment, to make the multifamily asset perform as efficiently and profitable as possible. Everybody gets paid more when the property performs better.