When we talk about the ABCs of multi-family real estate, we are really defining the property classes of the assets, or describing the characteristics of a potential real estate investment. The Classes are A, B, and C, and help classify a property based on geographic area, physical condition, and tenant and surrounding demographic characteristics. Each class implies different levels of risk, reward, challenge and value. When reviewing syndication offerings, these are often referred to as class A, class B, class C and even class D.

Class A – Multi-Family Real Estate

These are usually the highest quality properties in their market and geographic area. These are commonly the newer buildings built in the last 5 to 10 years, have the best amenities (covered parking, dog parks, pool, storage lockers, etc.), have the latest high-end finishes and appliances, are in highly desirable, well-located areas, and are considered safe places to live. They command the highest rents and typically have high-income earning tenants and low vacancy rates. They are generally operated by professional management teams, and have little or no deferred maintenance. Major employers, hospitals, universities, and arts and cultural activities are usually close by and sometimes within walking distance. Additionally, they will typically have good access to public transit and/or highways.

As the underlying economics of this multi-family real estate class of property are strong, a class A property is usually considered a safe investment, meaning the risks are very low when compared to other property classes, as this is where people generally want to live.

Class B – Multi-Family Real Estate

A class B community is one step down from class A and can be a little bit older, show some minor wear and tear and slight deferred maintenance issues, may have lower income tenants, and might be in a slightly less desirable part of town. There may be fewer amenities, and command lower rents, but still tend to attract quality, stable tenants. Though the actual buildings might be in good condition and well maintained, investors may see a value-add opportunity. They know that upgrades can be performed to take it to a B+ condition through improvements or light renovations to common areas, facades and landscaping. There can be a high-quality third-party professional management team on premises, but this is not always the case.

Because this type of property is seen as slightly riskier than a class A property, it can often be acquired for less of an initial investment, making it highly desirable for syndicators. Vacancy rates can be a little higher than a class A, but usually less than a class C property. When underwriting a class B property, syndicators recognize that maintenance costs can be higher than a class A property, which can be a factor in calculating monthly pro forma expenses.

Class C – Multi-Family Real Estate

Typically, more than 20-years old, class C properties are situated in less desirable neighborhoods, and are in need of significant upgrades, both cosmetic and sometimes structural. There tends to be lots of deferred maintenance, not very much in the way of tenant amenities, and in fact might be a rather ugly place to come home to. There might be visible signs of deterioration, overgrown vegetation, crumbling parts of the buildings, and even safety issues. Major employment centers, grocery stores, restaurants, and pharmacies can be farther away, and the neighborhood might be in a high crime are. Tenants might not be the most stable resulting in higher vacancies and defaults.

Class C multi-family real estate can be lucrative for syndicators who have a solid business plan and strategy. Though riskier and more management intensive when compared to a class A property, the opportunity for big ROI is very real. Rents are usually lower because tenants cannot afford the alternative, so underwriting needs to reflect this. However, class C properties offer the potential for the highest cash flow.

Class D – Multi-Family Real Estate

These are the properties in what I call war zones. They are in the most dangerous areas, have the most deferred maintenance (to be polite), and are often in areas of high crime and poor schools. These are some of the most challenging properties to manage, becoming very time intensive when it comes time to collect rents. Though acquiring these types of properties can be really inexpensive and cash-on-cash returns for the investor might look great, this is the highest risk of the classes above.

Factors Affecting Classification

There are many factors that affect how a property is classified. These include building age and condition, tenant amenities, location and demographics. These should be considered simplifications as there are lots of blurred lines and subjectivity.

The property age influences the classification in a general manner. Class A multi-family real estate properties are usually newer construction, built within the past 5-7 years or so. Class B communities will generally be 8-20 years old, while class c buildings will be over 20 years old. But just because a building is a certain age does not make it part of a certain class. Condition of a property is also a key factor in classifying it. If it is in pristine condition and 10 years old, it could still be considered a class A property. As might be a historic property that has been lovingly restored. A property that is very much in need of repairs, run down, ugly and not very well taken care of that is 10 years old could likely be labeled as a class C property. Age alone won’t govern a building’s class, as it must be considered together with all other factors.

Properties can be considered class A if they offer a healthy and desirable set of amenities. These can include on-site fitness center, concierge, underground parking, shared work spaces, theater rooms, and more. A class A property supports a lifestyle that residents are willing to pay premiums for. Class B will have less than class A, and class C properties usually have the least, if any, amenities to offer tenants.

The most attractive tenants, the ones with the high credit scores and higher incomes, will usually be found in a class A property, where the B and C communities will usually have less desirable tenants. Class A properties will usually be in areas of high employment and incomes, and will likely be in the neighborhoods with the higher home values and better schools. Classes B and C will be the less affluent and fringe areas.

Forcing Class Changes

What is meant by a class C property in a class B area? This is a very common scenario for syndicators as it encapsulates the built-in potential of an investment. The most exciting and profitable projects can be a C property located in a really desirable area, a class B area. When the sponsor can make a run-down building look like a million bucks, and bring it up to the standard of the surrounding area, there is a high potential for success.

The Sweet Spot

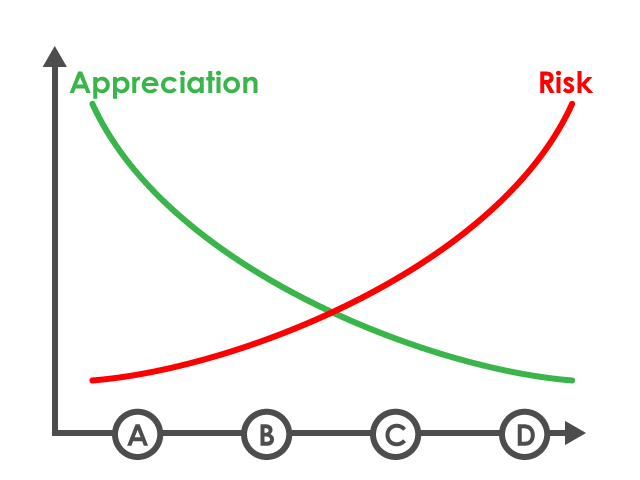

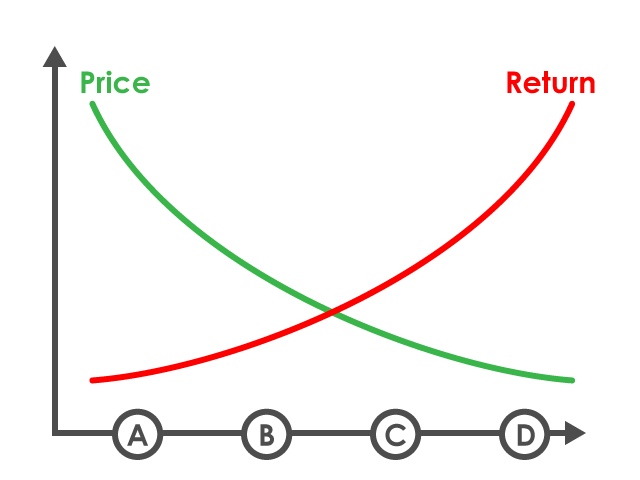

A class A property generally costs more to acquire and will have less risk associated with operating it. It will likely have less in the way of returns due to the lower risk, but it will be more likely appreciate in value when it comes time to sell.

Alternatively, a class C property will cost less for its initial acquisition, but will be a riskier investment. The good news is that it will likely make more money from its operation versus any natural market appreciation. Since many syndicators are working a value-add plan on their class B or C projects, forced appreciation comes into play. As you can see by the diagrams, maximum benefit usually comes from class B and C projects.

Helpful Reading

5 Multifamily Investment Opportunity Characteristics

The Hands-Off Investor, an Insider’s Guide to Investing in Passive Real Estate Syndications by Brian Burke