Underwriting in the context of commercial real estate simply means researching all the extenuating factors of an investment and mitigating its risks by allocating resources appropriately. In English: Doing your homework… Learning everything you can, leaving no stone unturned, and figuring out what the cash flows will look like based on the available evidence.

Upon moving forward with a property acquisition, the syndicator will put together a forward-looking document that contains all incomes and expenses. This is called a pro forma and will be part of the offering package you will be invited to review. But in order to get this far, underwriting must be completed.

The underwriting of a property includes two major parts: due diligence as well as pro forma projections. Each affects the other. By this I mean what is found in due diligence has direct influence on the pro forma, but neither the due diligence nor the project will likely go forward if the projections are unfavorable. By the time you see an investment offer, syndicators will likely have completed all parts and sub-parts of the due diligence and will have determined that a project can and should move forward.

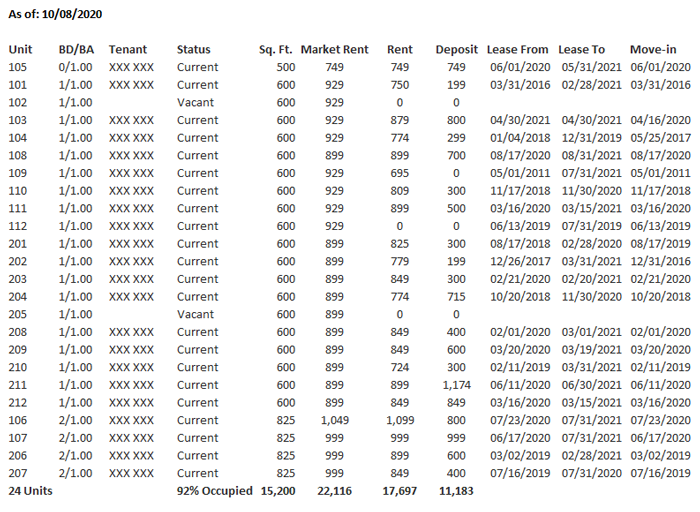

Rent Roll and Income Statement

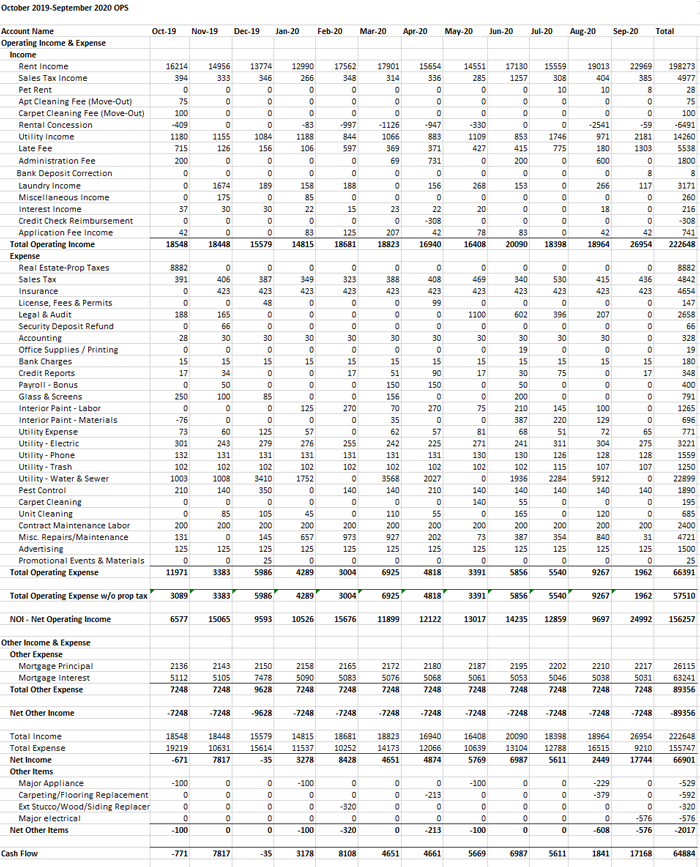

One of the things that syndicators look for in an acquisition is the financials. This underwriting includes the rent roll and the income statement.

The rent roll is the current operator’s list of income received in the form of rents and fees. It will account for every unit at the property, show the current rent payments received, the lease term, when rents are received for the current month, late fees assessed, and usually the going market rate for each of the units. This is a snapshot in time, and is usually archived on a daily, weekly or monthly basis, and analyzed over time to see trends or to help plan for future activities.

The income statement will usually be in the form of a trailing 12-month (T-12) accounting of all incomes received through rents and other fees, as well as all expenses, utilities, legal fees, admin and marketing costs, and taxes for the 12-month reporting period. In the income section, other than rents, you will see laundry income, pet fee income, application fee income, utilities reimbursements, and other fees that tenants pay the operator. In the expenses section, you will find all costs broken down into categories, and will often list debt service payments.

By analyzing the statement over the last 12 months, a sponsor might find trends of where costs are becoming out of control, or where the current operator was able to raise rents. They can also use this underwriting tool to help plan for future budgets and expectations, which is instrumental in producing the most accurate pro forma possible.

During the due diligence phase of the acquisition, it is the responsibility of the syndicator to verify all numbers and audit each and every lease agreement. When the syndicator has made it to the fundraising stage where they are asking for equity investments, the due diligence and underwriting phase should be complete. You should ask the syndicator to send you the audited rent roll and income statement, that way you can question anything that might be out of line. You will use these documents for the next step…

Verify Numbers

One of the first things you need to look at is how the pro forma is being affected by the current numbers in the audited rent roll and T-12. You need to see that the first-year rent aligns with the in-place rents. By this I mean that if you see a huge jump in either a positive or negative direction, you need to make sure this is accompanied by an explanation. For example, if you see a 4% increase in rental income, this may be the result of some facet of the business plan. Make sure that rent growth assumptions are reasonable, and can be supported by third-party market data. A conservative assumption is usually between 2% and 3% per year, but each market area will be different.

If there is a heavy lift at the beginning of a project, such as a value-add opportunity like renovations, there might not be any rent increases for a few years. This should be accounted for in the pro forma or the underwriting. If not, ask about it.

Looking at the historical numbers on the income statement, plus your BS detector, should help with ensuring all assumptions align with reality. For example, if you see rents in the pro forma being increased by $400 after the first 2 years, but the income statement only shows a $50 increase in the past year, this could be a red flag as the sponsor could be thinking and projecting too optimistically. To me, this signals a high-risk plan and I would want to be appropriately rewarded by that extra risk with a higher return on my investment.

Debt Structure

Look at things like the interest rate and payment terms and how they affect cash flows in the cash flow projections. There might be an interest-only (IO) period for the first few years. Watch what happens to the underwriting numbers when this period is over. Also, make sure the loan is compatible with the business plan. You might not want to invest in a project that last 5 years, but the agency loan matures in 3 years. You would want to see a bridge loan in this case. What if the sponsor is unable to refinance? Another thing to look out for is a huge prepayment penalty when the property sells. This could wipe out any profits made on the deal.

Sensitivity Analysis

Assuming the project will go exactly as planned is always the wrong assumption. Stuff happens. So, this is the area where you want to start asking what-if questions. One of these underwriting areas is a break-even occupancy ratio. This is the number that shows the break-even point for a project to not make money. Anything below this causes a loss. You want this number to be as low as possible in order for increased success with your investment. Often, a good break-even ratio might be 60% occupied. In this case, this means that the syndicator can still make money on a project if they maintain occupancy above 60%.

Different markets and neighborhoods have different average historical vacancy figures. 6%-11% vacancy is not uncommon, but let’s say that the area of the investment property you are looking at has an average vacancy of 12% and the syndicator’s break-even occupancy is 90%, you have a problem. The margins are just too thin to justify an investment. Alternatively, if the historic vacancy is 6%, and the break-even occupancy number is 70%, this gives a 24% cushion in case anything goes wrong. I would consider this to be a good project to invest in, though I would prefer a 50% occupancy break-even point.

Exit cap rate assumptions are another area to check underwriting sensitivity. A good rule of thumb is to add 10 basis points per year. So, if the cap rate is 5.2% at acquisition and the sale is projected to take place 3 years later, the cap rate assumption should be 5.5%. This is not to say that this WILL happen and that the cap rate will go higher, but it does keep the underwriting on the conservative side. If the selling cap rate stays the same as the acquisition, that’s a bonus. A good offering memorandum will include a chart of what happens to capital gains (or losses) at various cap rates.

Another great chart to see is an IRR matrix, the internal rate of return at different occupancy rates against exit cap rates. For example, an IRR might be 20% at a 3% vacancy and 5.6% exit cap rate, but could go down to 9.5% at a 12% vacancy and exit cap rate of 7.5%. This type of sensitivity analysis is very powerful when making a decision to invest or not invest.

Due Diligence Findings

As the sponsor conducted their underwriting and due diligence, they will have scrutinized property data and poured over every number possible. They will have reports noting the condition of the property and capital improvements that have already made. Zoning, title, survey, appraisal, and environmental reports are other items that the sponsor is responsible for ensuring have been completed, and have been acted on if needed. They will have studied insurance history and loss run, as well a property tax records to see if there are any opportunities there. Upcoming or threatened litigation or violation notices need to be taken into account as well in case there are issues that can be resolved.

Debt terms will have been negotiated and a final term sheet should be made available to you if you request it. The sponsor will have combed through bank and financial statements as well as defining a personal property inventory that convey upon purchase. Maintenance records, plans and drawings, should be in the hands of the sponsor at this point, as well as know if there are any items like roofs or A/C units under warranty.

Many locals require certificates of occupancy and the property might need an inspection during the escrow period. Syndicators will need to ensure all licenses or permits are in place and accounted for, as well as assess existing service contracts, determining which ones should continue and which ones need to be renegotiated.

Final Thoughts

Buying an apartment community is a complex process, and there are many other items that must be addressed. The point is that everything is done and that you feel comfortable that your investment is in good hands. Good syndicators know this process very well, giving you the ability to relax and to breath the fresh air.

Helpful Reading

The Definitive Guide to Underwriting Multifamily Acquisitions: Develop the skills to confidently analyze and invest in multifamily real estate by Robert Beardsley

The Hands-Off Investor, an Insider’s Guide to Investing in Passive Real Estate Syndications by Brian Burke