The short answer… any residential property consisting of 5 or more rental units. But there is a lot more to this that meets the eye. To truly understand how multifamily commercial real estate is defined, it is important to understand the context of where it fits within the myriad of commercial real estate types.

Types of Commercial Real Estate

Commercial real estate is generally property that is used specifically for businesses or for generating income. It provides investors with rental income and/or opportunities for appreciation, and typically requires more sophistication on the part of the investor as well as larger amounts of capital.

Multifamily – This segment is the main focus of the materials you will find here on Actively Passive. This category includes apartment complexes or high-rise apartment buildings.

Retail and restaurant – This category includes brick and mortar store and eatery properties on highway frontage roadways, in regional and outlet malls, small neighborhood shopping centers such as strip malls, larger shopping centers with grocery stores and other big-box anchor tenants. They can be single- or multiple-tenant buildings.

Hospitality/Hotels – From budget to luxury, this type of real estate at its simplest is usually defined as an establishment providing lodging and other services, for one or more nights, for people traveling on business and pleasure. While this often includes shopping, dining and spas, hotels come in many sizes, shapes and flavors. The many subcategories including full service, limited service, short-term rental, and extended stay.

Office – This type of commercial real estate includes single-tenant properties, small professional office buildings, downtown skyscrapers, midtown midrises, and everything in between. This is non-residential property leased by companies rather than individuals.

Self-storage – This is storage space like full rooms, both indoor and outdoor, or smaller lockers and containers, and is rented to individual or business tenants, on a short- or long-term basis. It is similar to multifamily real estate in that many self-storage properties have hundreds or thousands of units to rent out, but is not designed for people to live there – just their belongings. Some successful storage facilities offer value-add services like being able to buy cardboard boxes or renting moving trucks.

Warehouse – Although warehouses are a form of storage, they encompass a great deal more. These are places, usually large and cavernous buildings in industrial parks, that can be used as distribution centers, fulfillment centers, truck terminals, cold storage warehouses, and retail spaces. Due to the need to have facilities that enable online commerce, the demand for warehouse space has dramatically increased in recent years.

Industrial – This category not only includes warehouses listed above, but also includes factories and assembly plants needed for manufacturing, showrooms, and laboratories.

Medical – The healthcare real estate category is a niche having detailed technological and regulatory requirements, and are offices and campuses leased to healthcare community members or organizations. Examples include medical centers, hospitals, nursing homes.

Special purpose – These are sort of the miscellaneous category, and do not really fall into any of the divisions listed above. For example, sports facilities, churches, amusement parks, airports, and bowling alleys could be thought of as special-purpose facilities.

Land – This type includes investment properties on raw, undeveloped, sometimes rural land in the path of progress or future development. It can also be infill land in an urban area, possibly undergoing a zoning change.

Types of Residential Real Estate

This is commercial real estate designed specifically as places for people to live.

Single-family residence (SFR) – This is a free-standing building or home meant for one family or household.

Duplex – This is a building that is composed of two homes within one building.

Triplex – This is a building that is composed of three homes within one building.

Quadplex – This is a building that is composed of four homes within one building.

Apartment complex – Generally, anything larger than a quadplex is considered multifamily commercial real estate. Apartment complexes can be composed of several buildings inside of which there are several homes. While the minimum size of a multifamily property is 5, there is no maximum that I know of, and can consist of hundreds or even thousands of homes. These are usually owned and operated by a single entity to produce cash flow by charging for rents and other services.

Determination of Value

Properties classified as SFR, duplex, triplex and quadplex have their values determined by comparable sales (comps) of like-kind properties in a given market area, while apartment properties with 5 or more units are values by the underlying revenue streams they produce.

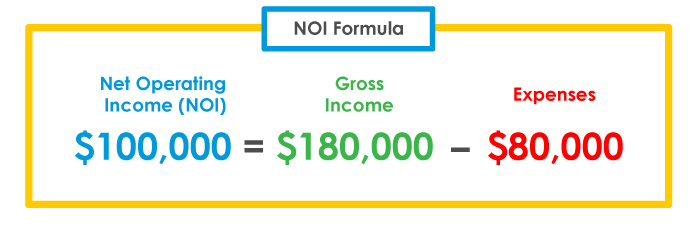

The single most important calculation of value is derived from the net operating income (NOI) as related to the prevailing cap rate of the area and/or class of the property. The NOI is calculated from rental and other income a multifamily property produces, minus all the expenses and salaries needed to manage a property. This does not include expenses for servicing debt, like mortgage payments. Nor does it include any cash distributions to any general or limited partners (investors).

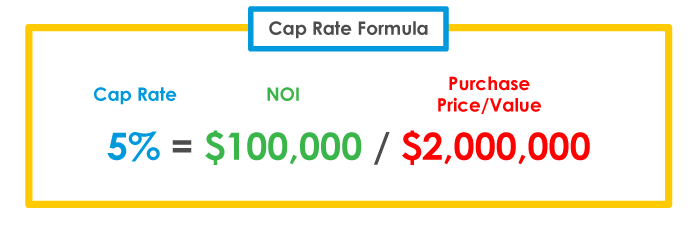

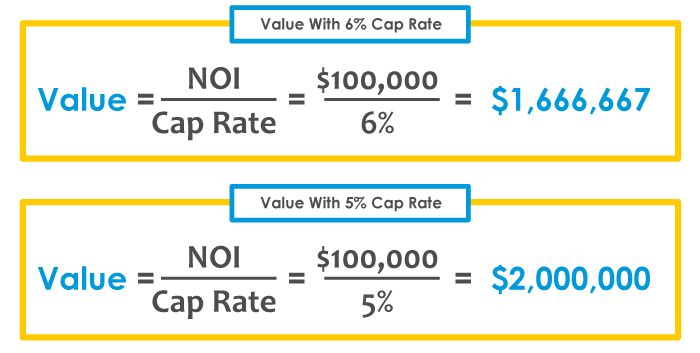

The cap rate Is an important metric used to determine a property’s value as compared to similar properties. Generally, the prevailing cap rate of an area works similarly to the comps used in single-family housing. Using this prevailing cap rate and calculating it with the NOI gives you a property’s value as compared to comparable properties. In a way, the cap rate can be thought of as a comp. Another way to look at it is the yield of an investment over a 1-year time horizon with an all cash purchase. It tells you how much you would make on an investment if you paid only cash for it (no financing), and is the NOI divided by the purchase price.

Types of Multifamily Real Estate

Garden style – A building style usually characterized by one- and two-story, semi-detached buildings, with the entry to each unit on the ground level. The development is typically built in a garden-like setting in a suburban, rural, or urban location, and may or may not have elevators.

Townhouse style – Similar to the garden style, these are usually 2 or more stories build like row houses, and may include private yards.

Tower – A high-rise apartment building with nine or more floors and at least one elevator.

Midrise – Sometimes referred to as a walk-up in the case of a 4-6-story building without an elevator, and a 4-9-story building with an elevator, typically in an urban area.

Luxury – Typically a class A property, newer and with many amenities, is an upscale apartment community where average rents are relatively high. They are generally located in highly desirable neighborhoods or business hubs, and tenants are more often white-collar workers and high-quality renters.

Workforce housing – Sometimes referred to as affordable housing, these are usually class B and C multifamily properties that cater to middle-income renters. The difference between workforce housing and affordable housing is that the former is for renters who make between 80% and 125% of the area’s median income, where the latter is usually meant for people who make less than 80% of the median income. There are fewer amenities than higher-end apartment communities, and these serve renters who are priced out of the market for apartments in the more desirable locations. There has been an increasing demand in recent years, and possibly a shortage in some areas, for workforce housing, and represents excellent syndication investment opportunities.

Manufactured housing community – Sometimes referred to as a trailer park or mobile home park, it is a community in which the operator leases ground plots and hookups to manufactured/mobile home owners. The operator might even be leasing a number of these units to residents.

Mixed-use buildings – This might include properties that have retail spaces on the street level, with apartment units on the floors above. In some cases, such as the John Hancock Tower in Chicago, these can contain retail stores, offices, gyms, spas, and TV studios, as well as condos and apartments.

Specialty Multifamily Real Estate

Student housing – Intended for students attending a nearby college or university, these are nowadays rented to students by the bedroom. A unit might consist of a 3- or 4-bedroom, 1- or 2-bathroom apartment, with the students sharing the common areas within, like the kitchen and living room. Many of these arrangements are full service, meaning that the operator provides utilities, weekly cleaning, and other services designed to make the lives of the students easier and assure the parents that their kids are being well taken care of.

Senior housing – Dedicated to housing senior citizens, these can be facilities that provide different levels of care for independent or even ailing seniors. These often have nursing staffs as well as community activities directors. Depending on the services provided, these are considered senior living or nursing homes. It is predicted that the demand for these types of arrangements will rise dramatically as the population ages.

Short-term rentals – Airbnb comes to mind when classifying this specialty. These take the form of bedrooms or even full properties being rented by the night or the week, and are most often operated like a hotel. This was considered a hot investment category up until the 2020 pandemic.

Corporate housing – These are often fully furnished apartment-style rentals that are rented for shorter periods, like 1-3 months, to companies that need to temporarily staff up in different geographic areas with employees that live outside the area.

Subsidized housing – This type of housing caters to low incomes renters or those with special needs, and is made affordable to income-restricted individuals through local government backing. Residents in these programs get a portion or all of their rent paid by the sponsoring government agency. Section 8 is one of these programs where the property owner is bound by some stringent rules to maintain a certain level of living conditions.

Final Thought

There are so many different types of multifamily real estate. When considering a syndication investment, it is a good idea to go with a sponsor who specializes in one niche. Experience and market knowledge are imperative to successfully operating a multifamily property profitably. Sponsors who spread themselves too thin or all over the place by operating several different property types can sometimes miss opportunities. That’s the last thing you want to happen when your money is involved.