You have made a decision to invest in a passive real estate investment syndication that offers great returns and with a team that you know, like and trust. You have been bored to tears by their mounds of paperwork including the Private Placement Memorandum, the Operating Agreement, and the Subscription Agreement. It was 150-300 pages of legalese that you obediently read and understood. You wired your $50,000 minimum investment from your self-directed IRA to the operator’s bank account. You received an official confirmation that all paperwork was in order and that you were officially one of the many limited partners of a multifamily project that you believe in.

Now what?

The passive real estate investment adventure continues. Will it be a bumpy ride, or will the syndication team execute every aspect of their business plan flawlessly? Welcome to the world of passive real estate investing.

Upon Closing

I once participated in a passive real estate investment syndication that had its closing delayed by factors out of the sponsor’s control. This was during the 2020 pandemic when everything was plagued by disruptions. But the sponsor persevered and kept all of us abreast of the latest developments. They never went radio silent. Communication was key then, as it is now. All syndication teams should offer this level of reporting at a minimum. Exceptional operators will keep their investors informed of developments and milestones all along the way.

As soon as the project closed, I’m sure everyone on the syndication team breathed a sigh of relief. I know I did. We immediately received an email telling us that the escrow had closed and that we were all the new part owners in a large apartment complex.

Included within that note was a high-level overview of what to expect moving forward and answered some frequently asked questions, including the one about the timing of our first cash flow distribution. It also addressed the first few onsite repairs to be made. In this case, the previous owner of the property had left water leaks un-repaired, adversely affecting the net operating income, and by extension, the value of the property. By fixing these leaks and avoiding the uber high water bills, the syndication team will be able to immediately add about $1,000,000 worth of value to the property. This is forced appreciation at its finest, and underscores my faith in the team to make my passive real estate investment passive real estate investment grow.

Progress Updates

You should expect monthly progress reports of the syndication project via email. These might include topics like the current occupancy or vacancy, the number of units that have been renovated that month, tracking status with the business plan, and hopefully some photos of the latest improvements. There should also be some clearly defined priorities or goals for the next few reporting periods, budget status, upcoming situations or market conditions to address, and even recent resident activities.

If a significant challenge arises that all the limited partners should know about, a good syndicator will not wait until the next monthly update or newsletter to bring it to your attention. They will get on it right away, and they will tell you how they are solving the challenge. These are unexpected events that come up and must be dealt with immediately. An example might be that the property was flooded and that residents are being moved to hotels until the water subsides.

Financial Reports

Every quarter, there should be some detailed financial reports sent to you via email or made available to you on the syndicator’s investor portal. While the monthly passive real estate investment progress reports are relatively high-level overviews of the various ongoing initiatives at the property, the financial reports should be very detailed, showing where in money came in or went out. There should also be some kind of comparison of the actuals versus the pro forma numbers that were presented to you before you invested. Ideally, you would want to see that the operator under promised and over delivered, and that renovation projects are under budget and/or incomes have been better than projected.

You should be presented with a rent roll, a document that shows the rental income potential, rents that are due and rents that have been collected, as well as which units are rented and vacant. It only shows gross rent collected, not the net rent after expenses. This information is found on the profit and loss statement (P&L).

The P&L is usually organized into the trailing 12 months, and is sometimes referred to as a T-12 (for trailing 12 months). Overall, this is a line-by-line breakdown of exactly how the property is doing financially. This large spreadsheet will account for every dollar spent at the property. Some people find these boring, but I like to look at a T-12 to see if there are trends in spending that can be averted or taken advantage of.

Cash Flow Distributions

Finally, the whole reason you got onboard with passive real estate investing in the first place, the distributions. I like to think of this as mailbox money, in that I do not have to do anything on a project other than making that initial investment, and money ‘magically’ appears in my account every month or quarter via direct deposit.

The amount distributed will likely vary each time and will be directly affected by the amount of money there is available to distribute, as well as if there is a preferred return, or how any profits are supposed to be split. It is not uncommon for distribution in the first year of a syndication to be minimal or nonexistent. This is usually the time period where the value-add business plan is being executed, and there is a lot of capital expenditures.

You should expect the investor portal to allow you to see your investment account balance as well as the overall value of your investment shares, just like you would when you visit your bank account online. You should also see recent account activity regarding distributions. These notifications should be very granular and include amounts of return ON capital versus return OF capital.

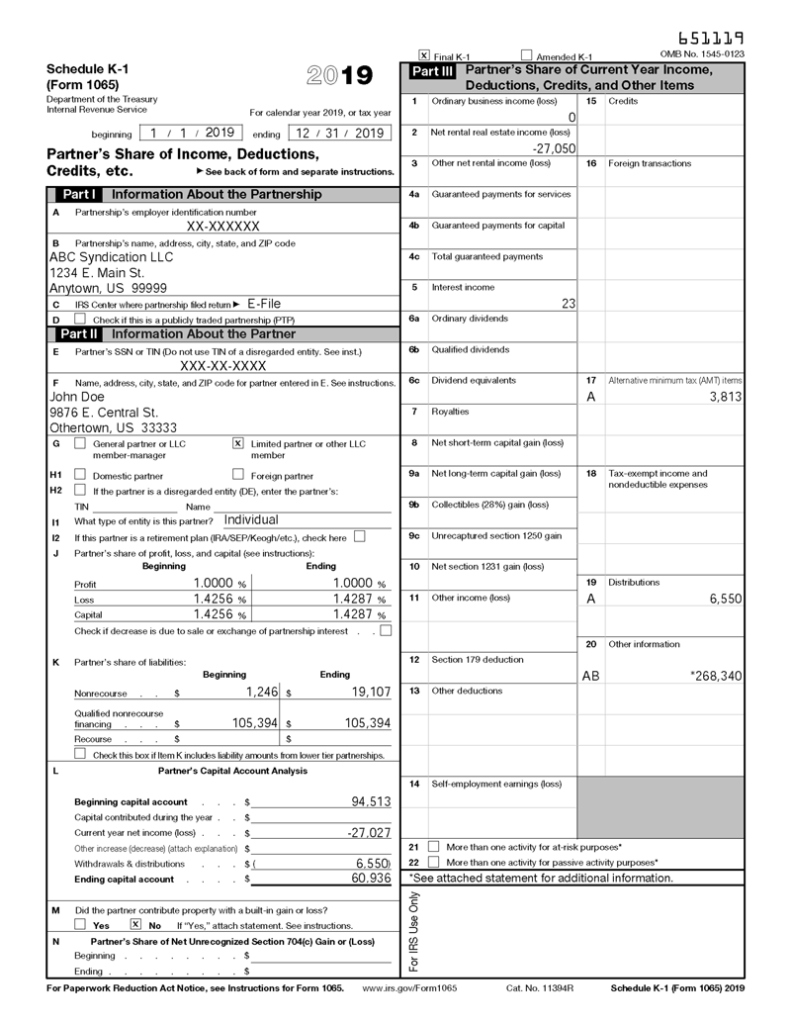

Schedule K-1

You can expect to receive a Schedule K-1 every year during tax season that should be attached to your tax return, and shows your share of income, deductions, and credits. This will likely show up in March or April, but can be delayed for various reasons. This is common. If this happens, you will it is advisable to file for an extension so that you do not get hit with a failure-to-file penalty. Estimated taxes still have to be paid at this point, so you might need to contact the operator and ask for draft K-1s. This will help you determine your estimated tax liability (if there is one). Uncle Sam always wants to get paid.

Final Word

It can take a bit of set-up effort to get to the point where you are investing passively in syndications, but once you become a limited partner on an investment, your work is basically done – except for tax time, but you will likely pass the annual K-1s over to your tax preparer and be finished. I really like the idea of my money growing without my involvement with day-to-day management decisions. I like being part of the cheering section on the sidelines. It gives me time to focus on other things in my life – like exercise.