This is a hotly debated subject. How hard should your portfolio flex for real estate? Many traditional investment advisors, especially the ones that work with hedge and mutual funds, will tell you 5%-15% should be your maximum real estate exposure with the rest of your investments in public markets (stocks, bonds, ETFs and mutual funds). I will always question this advice and reconcile where that advice is coming from, as there is quite a lot of bias in the investment community. Fidelity, for example, doesn’t list real estate as part of an investment diversification strategy in their many investment ideas articles. Blindly following traditional rules of thumb can leave the investor more exposed to unnecessary risk.

Disclaimer

I’m not an attorney or financial advisor. Consult your own legal and/or financial advisors before making any investment decisions.

Bottom line – The right allocation for you will depend on your risk tolerance, time horizon and additional factors specific to your unique situation. Let’s take a look at some things you might want to consider.

Overall Residential Real Estate Returns

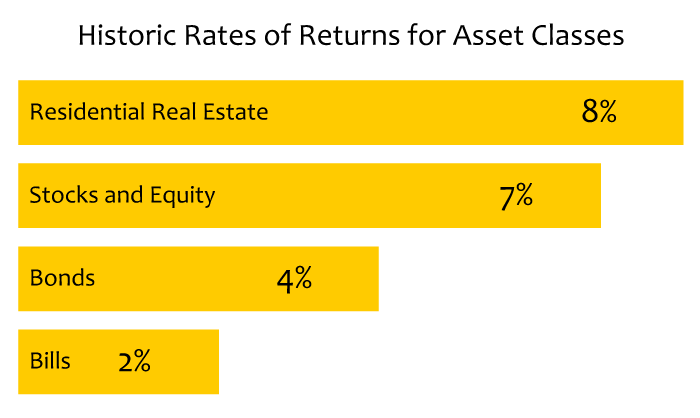

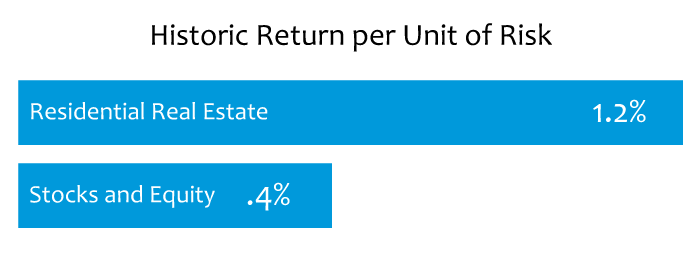

A research report entitled The Rate of Return on Everything, 1870–2015 suggests that the stock market performed at an average of 7% per year, but the real estate market, specifically residential, performed at an average rate of 8% per year. In recent years it has been much higher. To further drive home the real estate bias, the report shows that there is less volatility and risk in real estate. This would certainly imply that 100% of your investments should be in real estate… But wait…

The study focuses on unleveraged residential real estate – not ALL real estate. We know that commercial real estate consists of many categories in addition to residential (apartments): retail, self-storage, office, hotels, warehouse, etc. Although you can argue that there are certain correlations between single-family homes and apartments, the study really focused on the former… So, take those conclusions with a grain of salt.

Hedge Against Inflation

Real estate investments work very well with inflation. As inflation increases, so do property values. Many sources of valuable investment advice will tell you that holding leveraged multifamily real estate is a great hedge against inflation. I agree. The reasoning is that with a well-operated property, rental income pays down the debt as the property value increases due to inflation (and other factors). At the end of the financing period, it is theoretically possible to have a free and clear property valued at the resulting inflated value. It is well regarded that multifamily real estate investments (apartments) tend to benefit from inflation over the long term. As long as you are investing for cash flow, the risks seem to be minimized as well.

Multifamily real estate is a unique asset class. Not only does it have the ability to safeguard value during cycles of inflation, it also has the propensity to earn revenue through rental payments for leased apartments. As a real estate property appreciates in value, the debt owed on the asset actually depreciates in value with the rate of inflation. Additionally, rental income seems to always keep pace with inflation, further enabling the success of a real estate investment.

Risk Versus Reward

It is generally accepted that there is low volatility in real estate values, especially when compared to stocks. Even during the downturn between 2008 and 2012, when home values plummeted as much as 50%-60%, it was unusual for rent rolls of multifamily properties to decrease. In fact, they were still commanding the usual 1%-3% annual rent increase. Income-generating assets were able to ride out the crisis and emerge practically unscathed – as long as they weren’t forced to sell for some reason or another. As long as there is a positive cash flow, multifamily properties tend to hold their own, minimizing risks and maximizing returns at the end of the investment term.

Tax Benefits with Real Estate

One of the things that makes real estate investing very attractive is the ability to defer taxes through depreciation. You cannot do that with investing in most of the public markets. When you invest in a syndication, your share of the depreciation is made available for you to use against your earned income. But what happens to taxes when you invest in real estate with a Roth IRA? You can totally eliminate the tax burden. Additionally, if you were to invest using a self-directed IRA, you would only pay taxed attributable to the leveraged portion of the investment. (You would of course want to use that depreciation against those gains.)

Percentage in Real Estate Investments – Rules of Thumb

| Institution | Percentage |

|---|---|

| Deutsch Bank | 10% |

| Yale Endowment Fund | 17% |

| BNY Asset Management | 26% |

| Fidelity | 0% |

| Financial Samurai | 20%-35% |

| Forbes | 33% |

| Kiplinger | 19% |

| Motley Fool | 25%-29% |

| The Money Habit | 50% |

| Actively Passive | 80% |

Take Away

Your actual real estate allocation percentage or comfort level will depend on many things, such as your tolerance to risk, as well as your age and financial condition. It is recommended that you always talk to a financial advisor who is knowledgeable in real estate investments. Based on recent economic events, mine says 80%-90%. I like this advice.

Helpful Links

https://docs.wixstatic.com/ugd/31fb1d_86d07f6e17b8436a8cca3003ba461380.pdf

https://www.therealestatecrowdfundingreview.com/how-much-real-estate-is-ideal-for-my-por

https://fundrise.com/education/real-estate-is-a-hard-asset

https://www.fool.com/investing/2018/07/25/a-modern-approach-to-asset-allocation.aspx

https://www.financialsamurai.com/recommended-net-worth-allocation-mix-by-age-and-work-experience