So, you’re looking for places to invest, and looking at multifamily syndication investment opportunities all over the United States. But where do you begin? There are always going to be opportunities everywhere, but how do you move the odds of success in your favor. I think one of the best ways is to focus only on investments where population growth is very healthy. Growth in population creates demand for housing and helps keep rents maximized.

Alternatively, if everyone seems to be moving away from a certain area, demand for housing is dramatically diminished, which in turn can cause a good-looking investment to go bad. It is much more difficult to fill vacancies when there aren’t any people to fill them. That’s not to say that it is impossible, but why put yourself in that situation if you don’t have to?

Population Growth

Population growth is a huge factor affecting multifamily housing demand. When this happens, it indicates a healthy area that will likely support the other demographic measurements. We often see population growth driving income growth, or vice versa. Generally, the greater the growth in population, the greater the demand for apartments, as past population growth rates have shown. Demand is a key driver for rent increases. To support this, as population growth generates pressure on employers to increase salaries – incomes go up faster.

You should look for investment opportunities in areas with strong growth rates, where the population growth in the past 15-20 years is about 20% or greater. Do not invest in an area where the population is shrinking. Period. The cash flow might look great now, but you will likely lose money when it comes time to sell. Remember that this population decline is also accompanied by declines of incomes and depressed home values.

The best appreciation in investment values happens when an apartment community’s value increases over time as a result of positive growth in population, strengthened local economy, and even increased demand for rental apartments.

The Phoenix and Tucson areas are some of the hottest markets right now. With over 33,000 new apartment units being built and planned in 2020/2021, developers are working as fast as possible to meet the demands of a burgeoning population. But there are other areas as well. Take a look at the diagram below to get some great investment ideas.

Remote Work

One catalyst for growth in areas across the country is the potential for remote work coupled with the lower costs of living compared to the costs in bigger cities. Though the migration trend has been ongoing for the past several years, the pandemic forced people to see that remote work was not only possible, but in many cases more productive.

People in large and expensive city centers and employment hubs had an “Aha” moment, finding that they can keep their “city” jobs, but move to areas that are more affordable. People are now picking a place that they want to live, rather than a place where they have to live.

Migration Patterns

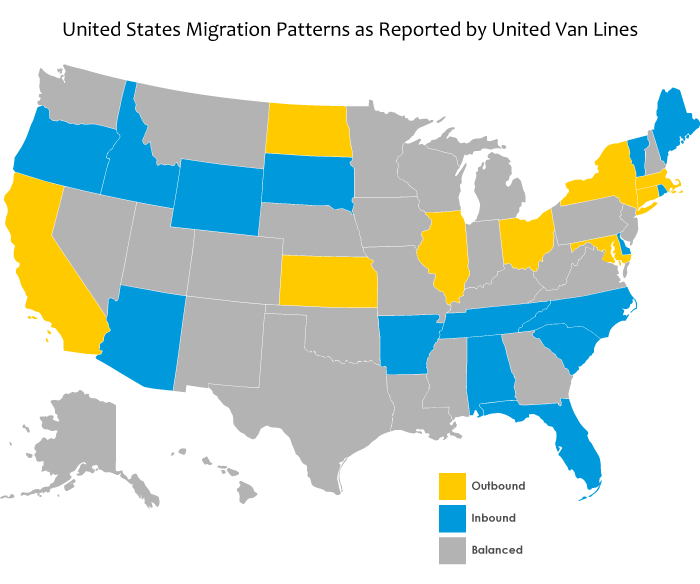

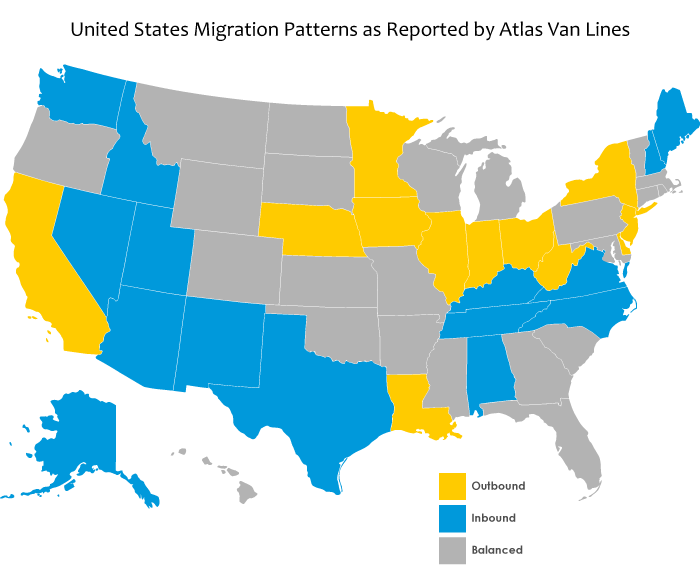

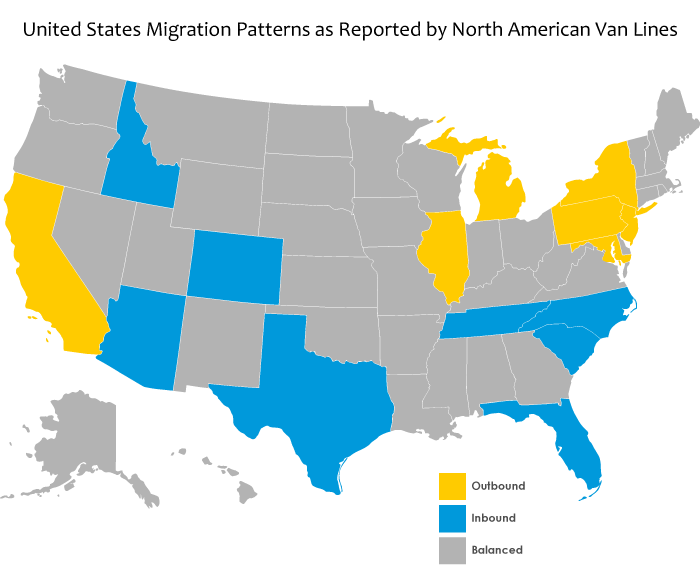

New investment markets have been opening up due to migration. During 2020, people in the US moved west and south, and away from congested areas. Some of the top US states for inbound population growth are Arizona, Idaho, Texas, Florida, Tennessee, North Carolina, Maine, and Alabama. Alternatively, some of the top states hemorrhaging population are California, Illinois, New York, New Jersey, and Virginia.

Some of the most well-known moving companies have been tracking the migration data for years. Take a look at their 2020 findings in the diagrams below. The data they collect and analyze are the one-way transportation and moves of household items. This data set seems to be a great bell weather to understanding where Americans are going.

Take Away

Research – Many populations declined in the bigger cities and increased in less expensive suburbs or rural areas. This trend is expected to continue and will have an impact, one way or the other, on the viability of many investment projects. Do your research and look at the population numbers before deciding on a specific multifamily syndication investment opportunity.

Diversify – As you grow your investment portfolio, it is wise to consider investing in different geographic areas or multiple markets in order to help limit the impact of a decline in any single investment. Again, make sure these are also in growth areas.